A key theme in this age of COVID is protecting against financial hardship. And ‘Mortality Risk Gap’ is a vital consideration. This is especially as we wind up the 3-month #ItStartsWithAction campaign on women’s financial wellbeing. Not surprisingly, it’s often the wife/mother who is acutely aware of the impact of financial risks on the family.

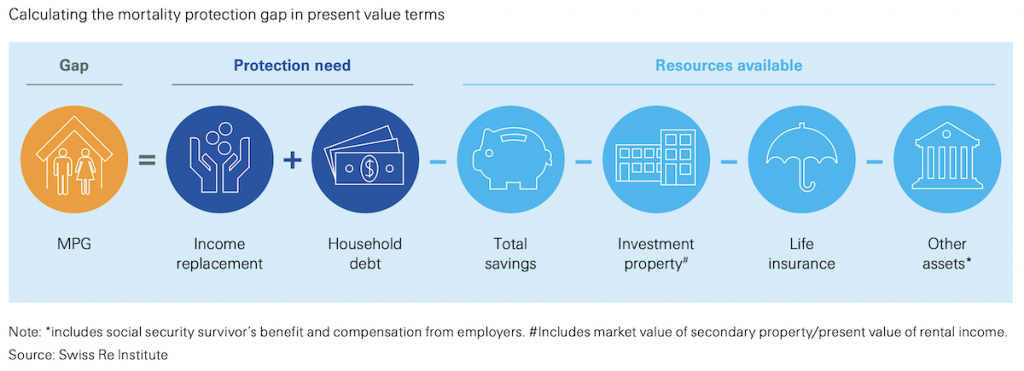

Priorities can sometimes seem out of whack. For example, when there’s collision cover of $14,000 pa for a luxury car but no life or disability protection for the primary household earner. Moreover, this breadwinner is often (but not always) the husband. It means there’s a gap between the protection needs of the household and the family’s financial resources. It’s called the ‘mortality protection gap’ or MPG.

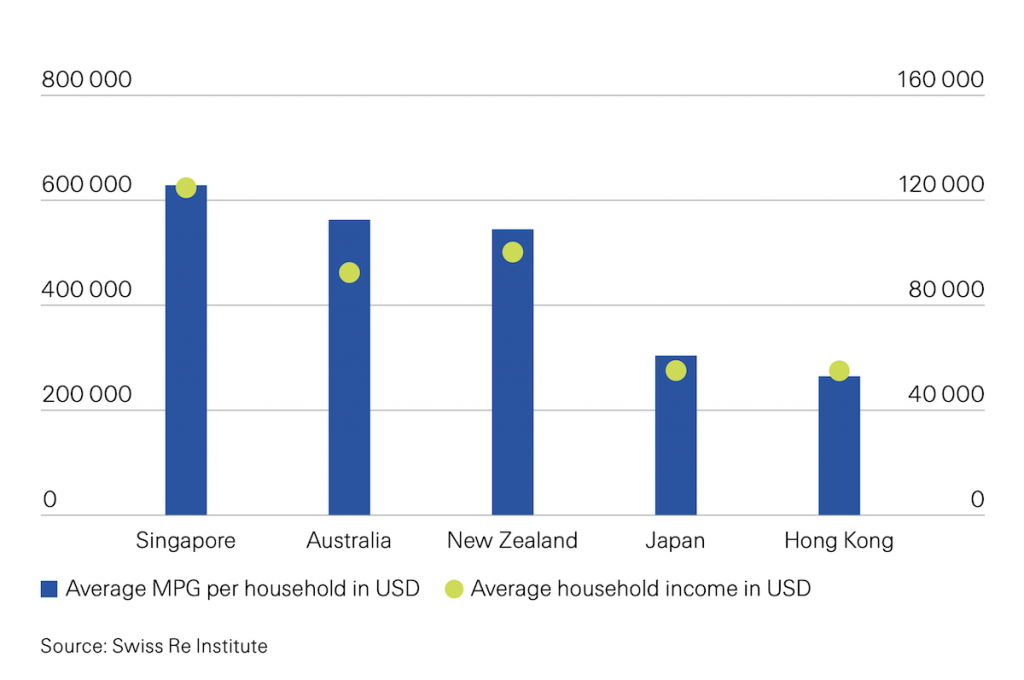

In September last year, a study of 750 New Zealanders was published by the Swiss Re Institute. It found an MPG of $839,000 (US$544,600) for each household on average for NZ.

Importantly, this gap is particularly stark among middle-aged professionals and the young.

Importantly, this gap is particularly stark among middle-aged professionals and the young.

Whatsmore, the MPG is increasing for New Zealanders. It’s set to expected to grow from $670 billion to $750 billion in the next 10 years.

Part of the calculation considers life insurance. Significantly, only 39% of people surveyed said they owned a life insurance policy.

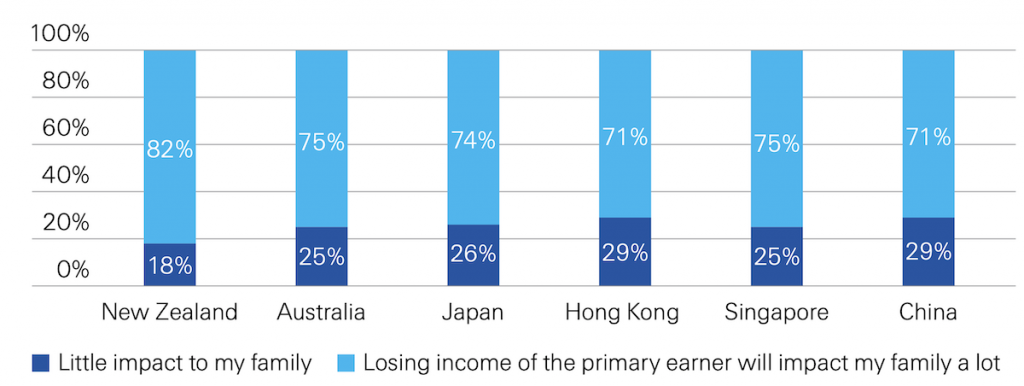

The study showed that 82% of the respondents are aware of the risks if the primary earner can no longer provide. However, they may still underestimate how much they need. There’s an assumption that family, friends, government or give-a-little platforms would help. Those who are most aware fall within several cohorts.

The study showed that 82% of the respondents are aware of the risks if the primary earner can no longer provide. However, they may still underestimate how much they need. There’s an assumption that family, friends, government or give-a-little platforms would help. Those who are most aware fall within several cohorts.

The study compared New Zealand with neighbouring countries. The graph below shows the levels of awareness of the impact of losing the primary earner in light blue. The dark blue shows awareness of the need to prepare for such loss.

We all can take steps to better prepare.

Taking action means we must prepare for unexpected and impactful risks. Importantly, even if we know what to do, we need to know how and take the next steps.

You can download the full study findings here:

https://www.swissre.com/dam/jcr:9fc4b2bd-ed00-41f7-ac4d-a72a1f6af100/swiss-re-institute-expertise-publication-closing-new-zealands-mortality-protection-gap.pdf