They called it the Wellbeing Budget 2022 with “something for everyone”, but will it make a difference to women’s financial wellbeing? The budget included health reforms, rural sector transformation, and cost-of-living measures. There were also changes for first home buyers, including the First Home Loan scheme. With the removal of price caps, eligible buyers would only need a 5% deposit, not 20%. Yet, property prices are still seemingly out of reach, albeit dropping in some markets.

The Financial Services Council (FSC) hopes to trigger more interest in women’s financial wellbeing as its campaign #ItStartsWithAction reaches its midpoint this month.

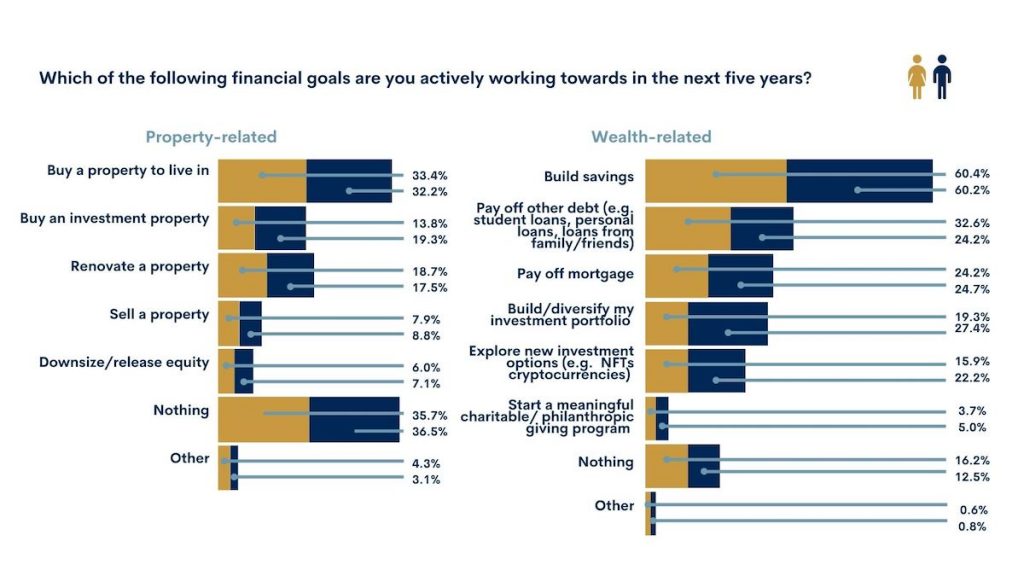

The ‘Money and You – Women and Financial Wellbeing in NZ’ report by FSC identified people’s financial goals. Buying one’s home and building savings were at the top of property- and wealth-related goals, respectively. In the survey, just over 33% of women indicated buying property as a home as an active goal. This compared to about 32% for men within the survey’s sample size of over 2000 responses.

A home can be more than just a building on a piece of land. It often provides security, control, privacy, and a sense of belonging to a community. Some say it’s a human right. But according to The Economist, housing has also become the world’s biggest asset class. In 2020, its value was just over US$258 trillion.

For a lot of us, the home is an investment, too. If solely an investment proposition, this period has been challenging to navigate. The bright-line test, new lending rules, and rising interest rates have brought significant change.

The FSC report suggests women are less likely to consider property as an investment strategy (13.8%) compared to 19.3% of men.

Sadly, over 35%, for women and men in the survey indicated ‘nothing’ when it comes to working towards a property-related goal in the next 5 years. Between 16% and 12%, women and men, respectively, indicating ‘nothing’ on a wealth-related goal.

With the cost of living around 6.9% for the year to March 2022, it’s no wonder that people are struggling to save or invest. Yet, starting earlier rather than later is key to one’s long-term financial wellbeing. Whether building equity in one’s home or saving/investing towards wealth assets, starting sooner helps.

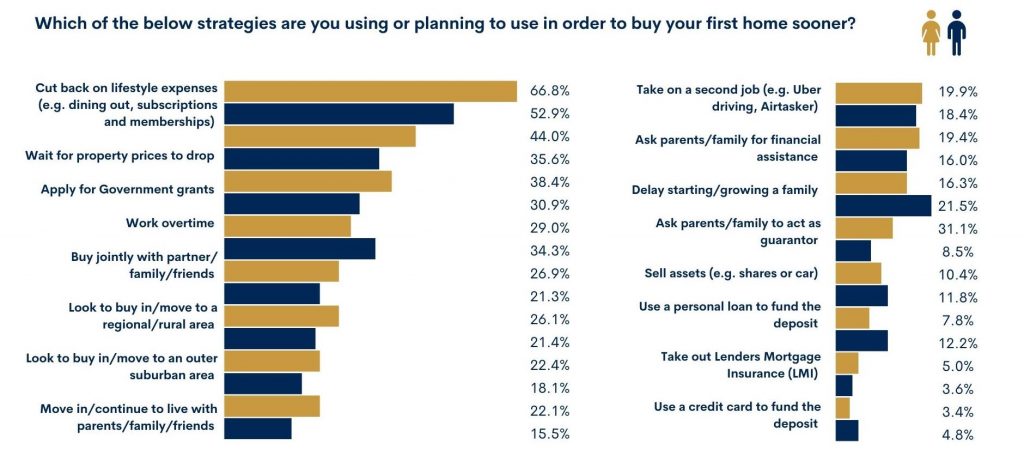

The same FSC study shows strategies toward first home purchases. These range from reducing discretionary spending to applying for grants or working a second or side hustle job.

Alongside changes to the First Home Loan, the government has raised the house price caps for the First Home Grant. It provides up to $20,000 for eligible couples towards their deposit. KiwiSaver members who have been in the scheme for more than three years can also direct KiwiSaver funds to the first home deposit. They may draw on their contributions, as well as employer and government contributions and the returns.

More often, deposits require not only KiwiSaver funds but other sources of savings. The bank of mum and dad is now the fifth-biggest lender in NZ.

Whether the house is one’s home or rental, it represents one course of action in financial wellbeing. The next campaign theme of #ItStartsWithAction, is ‘protecting what matters’. It considers how to protect what we value in our lives and how to prepare for the unexpected.

If you’d like to chat through some of the above or have questions we can help you with, we’d be happy to talk.

Call us on 09 307 9300.