Imak Director, Stewart Imrie says he recalls, (as a wee lad in the 80s) that women were told to get their dads to co-sign bank loans.

“I certainly wouldn’t stand for that today with my own daughters!” he says.

Times have changed, but even now, the label ‘stale, pale, and male’ is topical. This is especially as we recognise the impact on women’s financial wellbeing of COVID, care of children and grandparents, etc. It may manifest as concerns about buying a home, paying the mortgage, or investing for the future.

The Financial Services Council is leading a 3-month campaign with the theme, ‘It Starts With Action’. It will focus on women’s well-being across different ages and ethnicities, as a single person or with a partner.

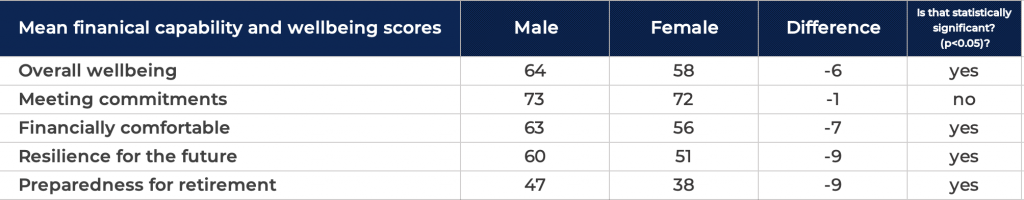

A survey of 3,027 New Zealanders in 2021 by Te Ara Ahunga Ora Retirement Commission revealed gender gaps in wellbeing scores.

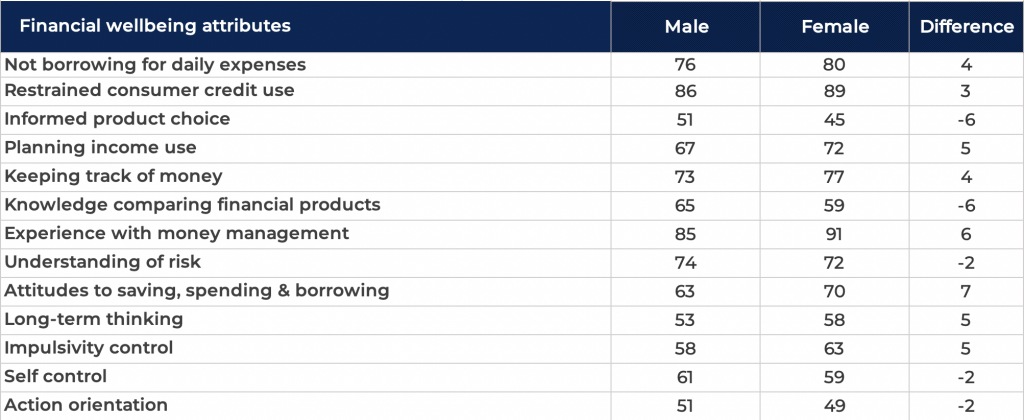

In our conversations with clients, we find that it can be hard just talking about it, not to mention taking practical steps. The study revealed some interesting scores on wellbeing attributes.

In the same research, women say they are more likely to manage the household.

On average, studies suggest women’s financial literacy is much lower than men’s. They experience more pay inequity, and they tend to take more time out to care for children or older family members. But whether a lad or a lass, young or not so young, it’s about making a start. Everyone can benefit from gaining more knowledge and understanding of how to improve financial wellbeing.

On average, studies suggest women’s financial literacy is much lower than men’s. They experience more pay inequity, and they tend to take more time out to care for children or older family members. But whether a lad or a lass, young or not so young, it’s about making a start. Everyone can benefit from gaining more knowledge and understanding of how to improve financial wellbeing.

Taking it step by step, beginning with a conversation, then action

You can read more about some of the research findings: https://blog.fsc.org.nz/2021-research-women-and-financial-wellbeing

If you have questions or feel we may be able to help, give us a call. You can reach me, Stewart Imrie on 09 307 9300 or my mobile, 021 765 765.